Double declining method calculator

The formula for depreciation under the double-declining method is as follows. Returns a value specifying the depreciation of an asset for a specific time period using the double-declining balance method or some other method you specify.

Double Declining Balance Depreciation Guru

A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the.

. Divide the basic annual write-off by the assets cost. Enter the straight line depreciation rate in the double declining depreciation formula along with the book value for this year. Use this calculator to calculate an accelerated depreciation of an asset for a specified period.

2 x 02 x 30000 12000. Determine the initial cost of the asset at the time of purchase. Formula for Double Declining Balance Method.

Depreciation per year Book value Depreciation rate Double declining balance. Use this calculator to calculate the accelerated depreciation by Double Declining Balance Method or 200 depreciation. For other factors besides double use the Declining Balance.

However subtracting this amount from the book value. Residential 14 Meals per Week. If you are using the double declining.

If we want to calculate the basic depreciation rate we can apply two formats. Description of DDB function. Calculating a double declining balance is not complex although it.

MACRS depreciation calculator helps to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. Double Declining Balance Method formula 2 Book Value. 2 x 02 x 30000 12000.

There are several steps to calculating a double-declining balance using the following process. It takes the straight line declining balance or sum of the year digits method. Although the overall amount of depreciation is the same with both methods the DDB method allows you to write off a different amount each year and recover more of your.

The formula for depreciation under the double-declining method is as follows. The double declining balance calculator also uses the same double declining formula to calculate. The following calculator is for depreciation calculation in accounting.

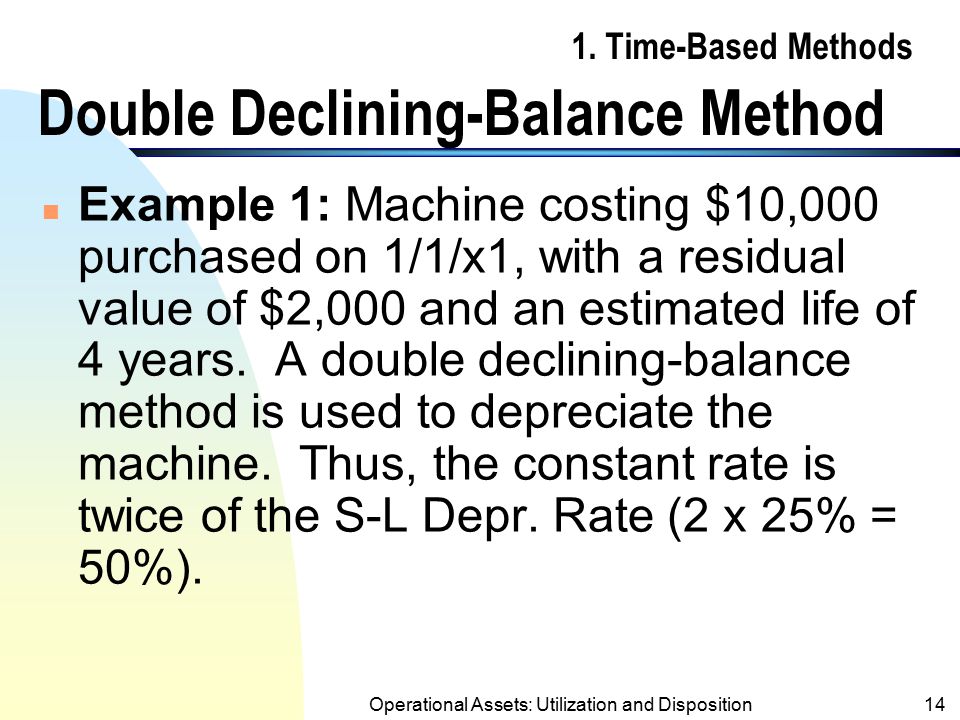

Double declining balance depreciation is an accelerated depreciation method that charges twice the rate of straight-line deprecation on the assets carrying value at the start. Multiply the result by. The double declining balance method of depreciation also known as the 200 declining balance method of depreciation is a form of accelerated depreciation.

Double Declining Balance Method. Double declining balance depreciation is an accelerated depreciation method that charges twice the rate of straight-line deprecation on the asse ts carrying value at the start of each. Double declining balance rate 2 x 20 40.

Depreciation Expense Calculator Cheap Sale 55 Off Www Ingeniovirtual Com

How To Use The Excel Db Function Exceljet

Declining Balance Method Definition India Dictionary

Fixed Assets

Depreciation Expense Calculator Hotsell 59 Off Www Ingeniovirtual Com

Depreciation Formula Examples With Excel Template

Double Declining Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

How To Use The Excel Ddb Function Exceljet

Double Declining Depreciation Calculator 100 Free Calculators Io

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

What Is The Double Declining Balance Depreciation Method Quora

Double Declining Depreciation Efinancemanagement

Double Declining Balance Depreciation Calculator

Finance In Excel 6 Calculate Double Declining Balance Method Of Depreciation In Excel Youtube

Double Declining Balance Depreciation Daily Business